It is a constant surprise, when I suggest to agency management that their clients are like an investment portfolio, and all I get are looks of confusion. Like a good investment portfolio, you need a mix of clients. The mix of these clients will and should depend on your risk profile and your growth strategy.

Instead of a portfolio strategy, many agencies appear to adopt a transactional approach to their client portfolio, based on opportunity and hope. They take any opportunity that presents itself to win the client and then hope they hold the business as long as possible. The problem with this approach is there is no strategic management approach to either winning clients or maintaining clients.

But with a investment portfolio strategy you start to take control and make plans for the agencies long-term growth and performance by creating a portfolio mix that suits your strategy. Let me share an example of this approach.

The low yield, low risk portfolio

A global network agency has a high proportion of globally aligned clients in the portfolio. These clients are on a global arrangement with low margins and reasonable volumes of work. But the pressure from the regional office was to deliver growth in the market. With no opportunity for incremental organic growth from these existing global clients, the initial reaction was to pitch for any local business possible, hoping for wins and revenue growth.

An investment portfolio approach indicated that they needed a mix of local business that was potentially high yield and low volume and medium to low yield but high volume. There was also a need for clients to create profile opportunities as the agency languished in industry perception for generating globally aligned creative work.

Using this investment portfolio approach the agency was able to be more selective and more focused in the new business strategy to proactively build relationships with key advertisers that met their portfolio needs. They would apply this strategy approach to deciding on if they should pitch for an account when an opportunity arises.

How to profile your clients

Most agencies will have a private perception of their clients: high volume, high demand, or high risk or not. The problem comes when financially profiling your client. No matter what the fee model type; retainer, project, performance or commission, most agencies will collect and analyse financial data such as average revenue per resource. Or perhaps look at the effective direct salary cost multiplier to determine margin and profitability.

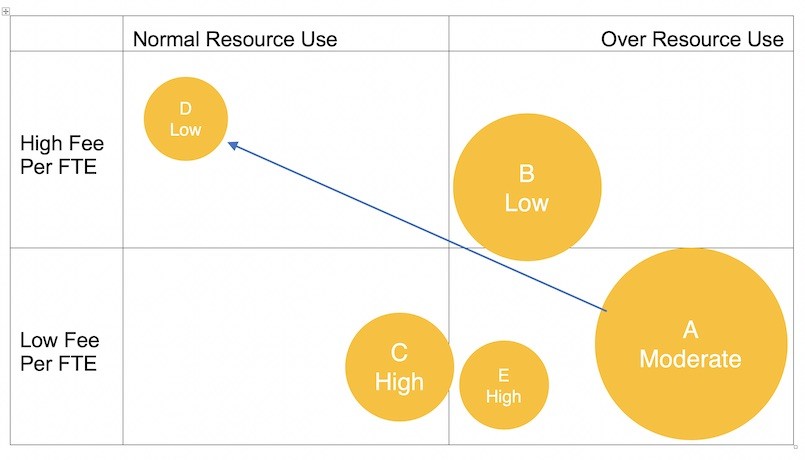

But neither of these measures actually captures the actual profitability of the client in the portfolio. Most of the agency financial evaluation of the client is based on the cost recovery of the resource and not the resource utilisation. To understand resource use, you need to look at the productivity of the resources. You need to look at the resource mix and the fee per full time equivalent (FTE) to identify the clients in the following quadrants.

Firstly, resource use is a measure of the appropriateness of the resource level to the volume of work being produced. Normal is where the level of resourcing is appropriate for the volume and complexity of the work being produced by the agency. Over is where the agency is under resourced and the agency resources are stretched to provide the volume and complexity of the work being produced.

Secondly, the fee per FTE is indicative of the financial yield of the client and the margin. Thirdly, the size of the client is indicated in the size of the fee circle. Finally, the risk associated with keeping the client is indicated in the circle.

Advertiser A is a large volume client, over utilising agency resources and paying a low fee, probably on the argument of economies of scale. However, it is likely that the volume of this client is subsidising the agency overhead, even though there is virtually no margin in this deal. This is typically a retained globally aligned client or a large services advertiser who has negotiated low fees and resources on the basis of their size and importance to the agency.

Advertiser B is a moderate sized client paying an average fee per FTE. There is some agency resource stress with over utilisation of the agency resources. Although higher fees per FTE could alleviate this by moving to a pricing-based output model.

Advertiser C is using a more normal and sustainable level of resources but still on a relatively low fee per FTE. A lower volume advertiser like this is often associated with being an opportunity to produce profile raising work and therefore the low fee per FTE is tolerated.

Advertiser D is a small client, possibly a local or independent and not aligned. It is unlikely they have a robust procurement team and therefore are paying a high fee per FTE and pose a low risk of changing agency as they would obtain a high level of service here.

In some markets these same clients can also be in the bottom right quadrant of low fee and high resource use with a high risk of change as they move from agency to agency driving lower fees and demand high levels of resources, represented by Advertiser E.

The natural indication is to want to move all clients from low fees and over resource use to the top left quadrant. However this is often not practical and is not necessarily required if you are taking a medium to longer term view of the client portfolio performance.

Managing the portfolio of clients

Smart agencies have a portfolio strategy for managing their clients. The first step is to understand the composition of your current portfolio of clients. Who are your high, low and moderate risk clients? Who are your high volume, seasonal and more bespoke clients? Where are your agency resources being over utilised and is there capacity on other clients? Which clients are underpaying and where is their fair, reasonable and sustainable revenue?

Commercially mapping all existing clients lets you see the opportunities within the existing portfolio and the actions needed to maximise the return on resource investment. There will be those clients that present little or no opportunity. While others will present opportunities to change resource plans or fee models to improve returns and alleviate resource overuse.

As previously stated, the portfolio mapping will also provide a map to identify the gaps and weaknesses in the current client portfolio and focus the agency on finding those clients who will balance the risk and returns for the agency. Then they can begin actively pursuing specific clients based on not just the lack of conflict, but for the commercial position they fulfil in the client portfolio for the agency.

We help marketers and agencies become great through the work they do together. What major business challenge could we help you solve?