Rigid, often instinctive rules have long governed the process of selecting an advertising agency, chief among them being the strict avoidance of competitive conflicts of interest (COI). This historical precept dictates that an agency, to maintain loyalty and confidentiality, must operate exclusively for a single client within a defined business category. However, as the global commercial landscape rapidly evolves, this zero-tolerance approach is increasingly proving to be anachronistic, stifling choice, and preventing clients from accessing the most specialised talent available.

The preoccupation with competitive conflict originated in an era of simplicity—a time when relationships were long-term, agency services were monolithic, and industry boundaries were clearly demarcated. The archetypal example was the classic “Coke versus Pepsi” conflict, where the agencies were seen as co-strategists, holding the keys to the brand’s most fundamental and secret competitive advantages. In such a zero-sum game, divided loyalty was indefensible.

Today, this preoccupation with competitive exclusivity is detrimental. It is driven less by quantifiable commercial risk and more by subjective fears, often summarized as the Fear of Missing Out (FOMO)—a persistent anxiety that a competing brand will secure superior creative talent or better media deals if they share an agency partner. To move forward, marketers must adopt a more enlightened, risk-managed view of COI, recognizing that the very nature of business, agency relationships, and marketing channels have fundamentally changed the equation. The commercial conflict is no longer a simple binary choice but a nuanced decision best managed by the client.

1. The Increasingly Complex and Blurred Commercial Landscape

The first major market change challenging the traditional COI paradigm is the dissolution of clearly defined business categories. In the 21st century, corporate diversification, acquisitions, and cross-sector collaborations have made broad category classifications almost meaningless, leading to complex indirect conflicts that are difficult to manage and often impossible to avoid.

Historically, a category like “Financial Services” might have meant a handful of traditional banks. Today, that category encompasses everything from traditional banking and insurance to superannuation, wealth management, and a sprawling ecosystem of fintech (financial technology) startups. A traditional bank might own an insurance arm, while a grocery chain might launch its own banking or payments platform. This diversification creates conflicts not just at the brand level, but at the sprawling, corporate revenue level, often without any direct strategic overlap in the day-to-day work of an external agency.

Moreover, the rise of collaboration between formerly competitive businesses further negates the conflict argument. Technology companies partner with retailers; airlines cross-promote with credit card providers; and telecom giants acquire media entities. In this environment, where the very act of commercial survival depends on strategic alliances, rigid exclusivity clauses become a restraint of trade that limits an agency’s ability to operate and a client’s ability to find experienced partners.

This shift highlights a persistent discrepancy between the agency model and the consulting model. Management consulting firms, digital consultancies, and research houses are actively sought out and valued precisely because they work across multiple clients in the same category. Their exposure to varied challenges allows them to accumulate a body of “normative data” and specialized category expertise, which they then deploy for the collective benefit of their clients. This expertise, built from working with competitors, is seen as leverage and an asset, not a liability. For an agency, existing category experience is often seen as a prerequisite for a pitch but a reason for disqualification if it is current—a logical contradiction that only serves to penalize the most experienced suppliers.

2. The Rise of the In-House Agency and Fragmented Rosters

The second powerful force mitigating the external agency COI is the fundamental restructuring of the client-agency relationship, marked by the decline of the Agency of Record (AoR) and the growth of internal capabilities.

For decades, the AoR held a privileged and exclusive position, responsible for setting overall brand strategy and often reporting directly to the C-suite. Their strategic centrality meant that any COI posed a genuine threat to the core business direction. Today, that model is largely obsolete. Clients are moving away from large retainers toward project-based engagements, and the agency roster is fragmented, including a wide array of specialized suppliers, vendors, technology companies, and management consultants. The external advertising agency is now one partner among many, reducing its centrality and overall strategic risk profile.

Crucially, the rise of the in-house agency, or simply the expansion of internal marketing teams, means that core business strategy, confidential intellectual property, and key data points are increasingly controlled and executed within the client organization. Internal teams are responsible for the critical decisions around product development, pricing, and overall market positioning. The external agency’s role has increasingly narrowed to tactical marketing communications, creative execution, or media buying. When the most sensitive strategic planning is kept within the four walls of the company, the concern over an external agency leaking high-level secrets to a competitor becomes less relevant.

If the relationship is less dependent, more fragmented, and focused primarily on execution rather than deep strategic counsel, it is unreasonable for a marketer to demand that an agency forgo all other commercial opportunities in an entire category. The AoR model’s demand for exclusivity is simply not justified by the reality of the modern, project-based agency role.

3. The Increased Focus on Performance Marketing

The shift in marketing spend towards digital channels has precipitated the third critical market change: the focus on performance marketing over long-term strategic brand building. This change fundamentally alters the nature of the risk associated with a potential COI.

Traditional brand building, which often involves highly creative, long-term, and confidential campaigns intended to shift brand perception, is inherently sensitive to COI. If a competitor gained insight into the early stages of a five-year brand platform, the damage could be substantial.

Performance marketing, by contrast, is a science of short-term, data-driven optimisation. It is focused on immediate results, conversion rates, click-through optimisation, and channel-specific tactical execution. The work is defined by rapid iteration, A/B testing, and short-term performance metrics. While data is involved, the true competitive advantage lies in the agency’s ability to execute efficiently and effectively in the channel—a skill that is often transferable and enhanced by working with high-volume clients, even if those clients are in similar markets.

The risk of an agency providing a competitor with superior optimisation techniques is less severe than the risk of them compromising a multi-year brand strategy. In a performance-driven world, the agency’s true value lies in its operational efficiency and specialised know-how, which, like the management consultant’s knowledge base, is built through repeated application across similar challenges. When the marketing focus is on optimising short-term campaigns, existing category experience becomes a tangible asset, not a threat.

The New Paradigm: Expertise Over Exclusivity

The cumulative effect of these three market shifts—category blurring, fragmented rosters, and the performance marketing focus—is the realisation that existing client work is often a demonstration of category expertise, rather than a conflict of interest.

This realisation is the central tenet of the modern agency search process, such as that employed by the TrinityP3 AI Agency Search service. By utilising advanced market analytics, the process is designed to look beyond arbitrary conflict definitions. If an agency has successful, measurable outcomes with a client in a similar category, this is weighted as a positive indicator of specialisation and knowledge. The AI search logic treats category experience as a form of expertise leverage that the client should want to access, not a red flag that demands immediate exclusion.

Agencies should not be forced into a “ridiculous, wasteful game,” where they must prove category experience from decades-old roles while being simultaneously forbidden from working with any current client in that same area. This outdated approach shortens the list of qualified agencies and denies the client access to highly effective suppliers.

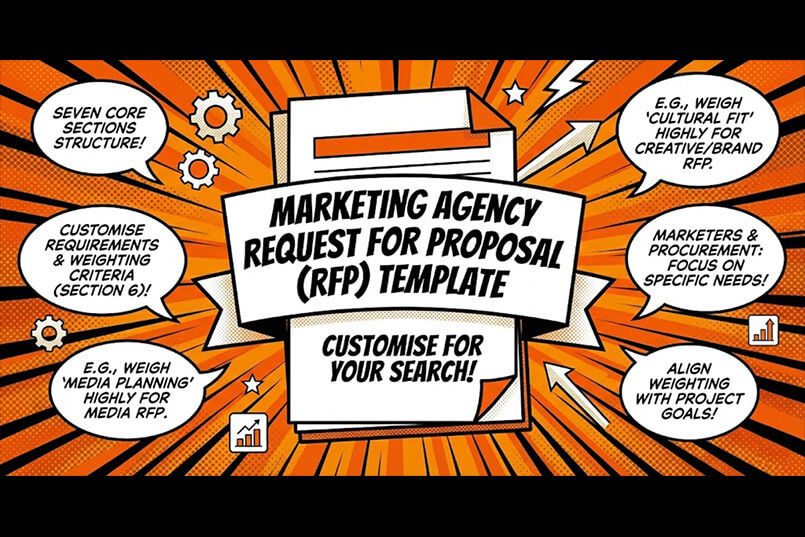

Ultimately, the responsibility for assessing and deciding on conflicts of interest must reside with the client. The client is best positioned to determine the nuance, considering:

- The Nature of the Work: Is the assignment high-level, confidential strategic planning, or low-risk, tactical execution?

- The Degree of Competition: Are the two clients in a genuine “zero-sum” race for the same audience, or is the competition indirect (corporate ownership, tangential product lines)?

- Mitigation Strategies: Can the agency successfully implement a “Paper Wall” (separate teams, data segregation, dedicated internal leadership) to manage the risk?

- The Value of Expertise: Does the potential risk of a perceived conflict outweigh the proven commercial value of the agency’s specialised knowledge and experience?

Moving forward, enlightened marketers must cease using blanket conflict-of-interest clauses as a default mechanism for elimination. They must define conflict narrowly, precisely, and with commercial reality in mind, enabling them to select the perfect-fit agency whose existing category experience is a valuable signal of success, rather than an automatic disqualifier. By placing the onus of responsibility on the client to perform a risk-benefit assessment, the industry can unlock superior talent and move past an outdated convention that no longer serves the modern marketplace.

Contact us here to book your BetterPitch Power Coaching Session, or here to learn more about finding your best-fit agency with the TrinityP3 AI-Powered Agency Search