Agency fees and commercial arrangements are essential to get right. But what is the right agency fee model? How much should be paid? And how do you manage and negotiate these fees effectively? While there is common practice in agency fee models, there is no best practice, with each fee model dependent on the discipline, services, volume, and more.

The objective of our agency fee advisory is to create fair, sustainable and mutually equitable models that are easy to manage, and which drive the desired outcomes.

We approach this challenging area from a number of angles, tailored in each project to fit specific need. You can explore them here:

Find more information on agency commercials arrangements here or explore more details and insights below.

How output pricing supports an agency subscription fee model

What are the real considerations and impacts of AI on agency fees?

The perils of agency hourly pricing: Lessons from a man and his lawn mower

How to avoid waste in your agency fees

Overcoming Obstacles to Agency Value-Based Pricing Fees

Why Value Trumps Cost in Agency Remuneration Fees

When it comes to paying your agencies, you need to follow the money.

The limitations of input cost over output and outcome value for advertising agencies

Your next agency pitch will cost you financially, but not as much as you think.

Advertising Agency Fees – The Move from Static Inputs to Valuable Outputs

With agency costs on the rise, how should advertisers respond?

Advertising ideas are a dime a dozen according to this advertiser

Common mistakes made when preparing a scope of work for the agency

The traps and pitfalls of developing an output-based agency fee model

Value-based, cost-based, pricing-based, and performance-based agency fees – bring it on

Past, present or future – which tells you more about your agency fees?

Will agencies absorb their advertiser budget reductions again?

Could advertising agencies be the next big subscription-based model?

The problem with setting agency fees is most are making it up

What is more important in assessing agency fees, productivity or price?

Five ways to use the Verificom toolkit to more effectively manage agency fees

Why hourly rates are no measure of value when negotiating agency fees

Why a scope of work is essential for managing agency value

Deciding on the right agency fee model is now easier

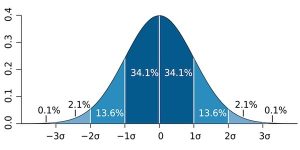

Is the problem with agency fee benchmarking simply a matter of statistics?

The difference Between Scope of Work (SoW) and Scope of Services (SoS), and why that matters

Retained AOR or project fees? Which one is best?

The challenges in measuring the value your agencies contribute to your marketing

Why performance based payments need to be an incentive not a disincentive