With the increased application of AI in generativing content and automating workflows, and the corresponding call for the application of output-based or value-based fee models, the majority of agency remuneration models are still being based on resource, or FTE, based (head hour project fees & retainers) models. It is therefore important for those working with these models to have a practical working understanding of the model to avoid confusion and mistakes.

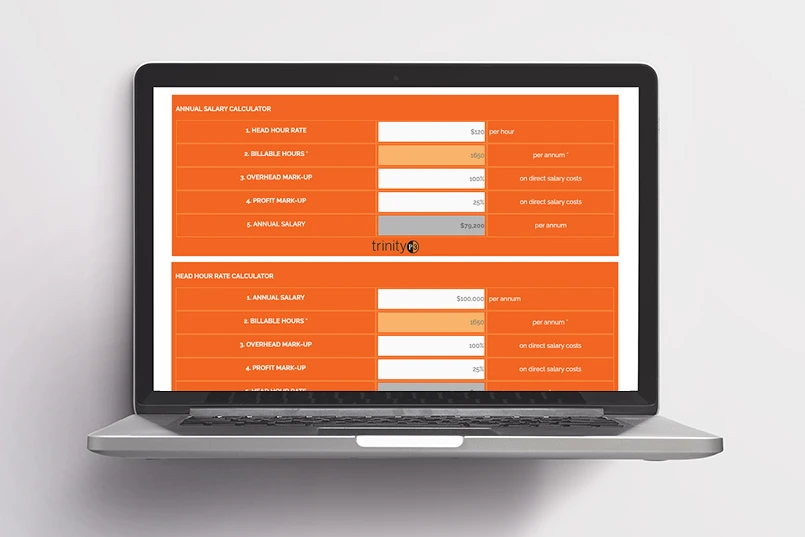

This is why several years ago, we developed the agency remuneration calculators you can find on our website here. (In case you’re looking for them, a couple of years ago we discontinued the mobile versions of these, and consolidated all the calculators in one place).

But while the calculator makes the process easier, we have found that some do not understand the underlying methodology. So, I thought it worthwhile to explain this in step-by-step examples.

You need to consider three things:

- The resources employed and their cost

- The cost of providing those resources

- Then how to calculate the total cost

The resources and their cost

A resource is a person. They get paid a salary, and they work a set number of hours a year for you – Billable hours per annum.

Salary

This is the easy part. What do they get paid? Some agencies also add compulsory pension/superannuation/health insurance and other benefits paid on the employee’s behalf. Others further add payroll tax and other directly related salary costs. Including these benefits is fine (i.e., the total “Cost To Company “ of employing someone), just remember not to double count these in the “Overhead” as well (more on this in a moment).

Billable Hours

Then you need to work out how many hours a year that person can be billed out \ so that you know how much they need to be charged out at to simply recover their salary. Billable Hours Per Annum is a factor of the number of working hours a year after you have taken out public holidays, sick leave, annual leave and non-billable time; you can find more information about this also on our website, at this link.

Salary Cost Per Hour

Then if you divide their salary cost by the number of billable hours per annum you get the cost per hour to recover their salary cost only. (Or Cost to Company, if that’s the base you’ve used).

But there are more costs in a business to be recovered than just the direct salary costs.

Those resources not billed directly to the client, such as the receptionist, the executive assistant, the finance team and the like are termed Indirect Salary Costs. Some agency personnel also manage other staff, and have leadership responsibilities – obviously, this time is not directly charged to clients and so is also included as Indirect Salary Costs.

They appear in the overhead costs of the business. Or the costs associated with providing the resources.

The cost of providing resources

The next part of the calculation is the costs of business. This is the overhead cost of the company and the profit markup or margin.

Overhead Mark Up.

This is typically expressed as a percentage of the direct salary costs. So in an agency there are the salaries directly associated with providing services and then all other costs provided with those services. Ideally you should calculate the Overhead Mark Up for the whole agency and recover the overhead cost across all clients. You can of course calculate this by client, but it requires apportioning the fixed costs of the business against each client, often based on a percentage of their contribution to total revenue.

For a view of what is and is not included in the overhead calculation, check out this post.

Overhead Cost

When you add up all of the direct salary costs you can multiply this by the overhead mark up and add it to the salary costs to calculate the cost of resources. This is sometime expressed as a multiple, which is what you multiply the Direct Salary Costs by to get the Overhead Multiple.

Profit Margin or Profit Mark Up.

There is a difference and so it is very important to be clear if you are discussing a mark up or margin. Profit mark up is the percentage mark up of the initial cost to get the final price. While profit margin is the difference between the initial cost and the final price expressed at a percentage of the final price.

Therefore if you are targeting the agency to achieve a 20% profit mark up and the agency is calculating a 20% profit margin there is a 5% difference between the two.

For simplicity lets stay with profit mark up.

How to Calculate the Total Cost

The profit mark up is applied to the sum of the direct salary cost and the overhead – not the direct salary cost alone.

That means that the profit mark up is rightly based on the cost of the resources which is the direct salary costs and the business overheads incurred to deliver these direct salary resources.

This is sometime expressed as a multiple, which is what you multiply the Cost of Resources by to get the Profit Mark Up.

If this is too hard, then simply check out the agency remuneration calculators you can find on our website here.

Or simply contact us and we can show you how to do it.

One thought on “A step by step approach to calculating ad agency resource rates and head hour costs”

Staying profitable is the name of the game and you either do that by trial and error or a workable formula when starting out. Mostly it is charging what the market will bear and by getting results that make your client profitable. So maybe client profitability or return on investment is another model to be looked at.

Comments are closed.